Being falsely accused of hitting someone’s car can be frustrating and stressful. It’s important to stay calm, gather the correct information, and follow the proper steps to protect yourself from unjust claims. Here’s what you should do if you find yourself in this situation.

Stay Calm and Gather Information

Stay Calm and Gather Information

Evaluate the Situation

The first thing you should do is take a deep breath and assess the situation. Look at both your car and the other vehicle carefully. Are there any noticeable signs of damage? Do the alleged damages match up, or is there something off about their claim?

- Check your car: Walk around your vehicle to see any signs of damage or scratches.

- Examine the other vehicle: Do the damages look fresh or old? Sometimes, people may try to blame you for unrelated damage.

If you’re sure you didn’t hit their car or the damages seem unrelated to you, that’s a good first sign. But it’s important to proceed cautiously.

Speak to the Other Party Politely

Even though you may feel upset or accused unfairly, staying calm when talking to the other driver is essential. Avoid being defensive or aggressive. Instead, try to understand their claim politely.

- Ask for their version of events: Say something like, “Can you explain what happened from your perspective?” This can give you a better idea of their thinking.

- Keep your responses neutral: Avoid admitting any fault or making accusatory statements. It’s better to stay composed and focus on gathering facts.

Document the Incident

Documentation is your best defense against false claims. The more evidence you collect, the better your position is if the situation escalates.

Take Photos and Videos

Your phone will be your best friend here. Make sure to document the scene thoroughly with photos and videos. This will give you proof if the case moves forward, whether it’s with insurance or in court.

- Capture both vehicles: Take clear photos of your car from all angles, including close-ups of any possible damage. Do the same for the other vehicle.

- Document the surroundings: Snap pictures of the location, street signs, or anything showing the environment where the incident occurred.

- Take a video: Sometimes, a video can capture more than a series of photos. Pan around the scene to get an overview.

Gather Witnesses

If anyone witnessed the interaction or incident, ask for their help. If things get more severe, bystanders can provide an impartial perspective.

- Ask politely: Approach any onlookers and say, “Did you happen to see what happened here?” If they did, ask if they would be willing to provide their contact information in case you need a witness.

- Take down details: Get their name, phone number, and a summary of what they saw. This could be invaluable later.

Check for Nearby Cameras

If you’re in an area with surveillance cameras, such as a parking lot, gas station, or even residential areas, you might have access to footage that can clear your name.

- Look for cameras: Glance for security cameras on nearby buildings or homes. If you have a dash cam, this is a great time to review the footage.

- Note the locations: Write down where you saw the cameras so you can contact the appropriate parties later to request footage if needed.

Contact Your Insurance Company

After you’ve gathered all the necessary information, the next step is to notify your insurance company. Even if there’s no visible damage or you think the claim is entirely false, it’s still a good idea to inform them of the situation.

Report the Incident

Your insurance company must be aware of the severe accusation or misunderstanding. Filing a report doesn’t mean accepting fault; it’s simply a way to cover all your bases.

- Call them ASAP: The sooner you contact your insurance provider, the better. You don’t want them to hear from the other party first.

- Be detailed: Provide them with all the information you’ve gathered—photos, videos, witness names, and details about the incident.

- Ask for advice: Your insurance company will guide you on how to proceed and whether further action is needed.

Explain Your Side Clearly

When talking to your insurance company, it’s important to remain honest and transparent. They’re there to help but also need to know the facts.

- Please stick to the facts: Tell them exactly what happened without making assumptions or accusations.

- Send evidence: If you’ve gathered photos, videos, or witness statements, send those over immediately—the more supporting documentation you have, the stronger your case.

By reporting the incident, you ensure your insurance company is prepared to support you if the false claim escalates. You also reduce the chance of it negatively affecting your insurance record.

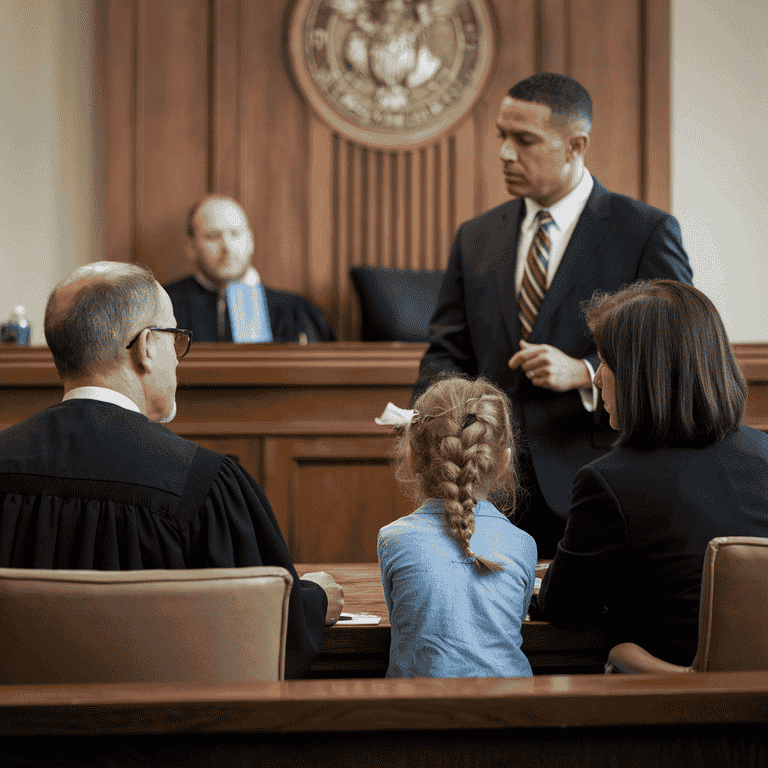

Seek Legal Advice if Necessary

If things start to take a serious turn—like if the other driver escalates the claim or gets their insurance company or a lawyer involved—it might be time to consult an attorney.

When to Consult an Attorney

Not every case will need legal involvement, but there are sure signs that you should be on high alert. If the other party is pushing for compensation or you feel the situation is becoming complicated, having legal guidance can be invaluable.

- When legal action is threatened: If the other driver hints at taking you to court, you should seek legal advice immediately.

- When your insurance company advises it: If your insurer suggests you seek counsel, follow their advice.

- If you’re being accused of something more serious, a lawyer is essential in cases where you’re charged with fleeing the scene or causing severe damage.

Prepare for Possible Legal Proceedings

If legal action does seem likely, it’s time to get organized. You’ll want to have everything to defend yourself effectively.

- Organize your evidence: Collect all the documents, photos, videos, and witness statements you’ve gathered and put them in one place so they’re easy to access.

- Understand the process: Your attorney can explain what to expect during a legal dispute. They can help you understand your rights and any next steps you should take.

A lawyer can offer peace of mind by handling the legal side, allowing you to focus on proving the false claim.

Dealing with Insurance Fraud

Sometimes, false claims aren’t just misunderstandings. There are cases where the other driver might be attempting insurance fraud. Knowing what to look for and how to protect yourself is essential if you suspect this could be the case.

Recognizing Fraudulent Behavior

There are some telltale signs that the other driver might be trying to scam the system. Knowing these signs can help you avoid falling victim to fraud.

- Suspicious behavior: If the person seems unusually aggressive, insistent, or pushing for immediate compensation, this could be a red flag.

- Pre-existing damage: If the damage they claim doesn’t seem to align with what you know about the incident or looks old, they might try to pin unrelated damage on you.

- Refusing to involve insurance: If they’re pushing for a cash settlement instead of involving insurance, this could be another sign of potential fraud.

How to Protect Yourself from False Claims

Preventing yourself from being a victim of fraud starts with being prepared. Taking steps now can help you avoid false accusations in the future.

- Keep thorough records: Always document any accidents, even minor ones. Photos, videos, and witness accounts can protect you from future claims.

- Install a dash cam: Having a dash cam can be a game-changer. It’s one of the best ways to document what happens on the road.

- Report everything: If the damage seems insignificant or you think the claim is minor, consistently report incidents to your insurance company. This ensures they have a record if anything comes up later.

Breaking It All Down

Finding yourself falsely accused of hitting someone’s car can be overwhelming, but the key is to stay calm and take immediate action. Gather as much information as possible—photos, witness statements, and any relevant documentation—so you’re prepared to defend yourself if the claim escalates.

Remember to report the incident to your insurance company immediately, even if you believe the accusation is entirely unfounded. They’ll be able to guide you through the process and help ensure that you’re protected. If things get more severe or legal action is threatened, don’t hesitate to seek advice from an attorney.

Finally, stay alert for any signs of fraudulent behavior. People sometimes try to take advantage of situations like these for financial gain. Still, by staying organized, documenting the scene, and involving the right parties, you can protect yourself and navigate the situation with confidence.

Frequently Asked Questions

What should I do if there are no witnesses?

If there are no witnesses, focus on documenting the scene as thoroughly as possible. Take photos and videos, and look for nearby security or traffic cameras that might have captured the incident. Your documentation will be critical if the situation escalates.

Can I still be held responsible if there’s no visible damage?

Even if there’s no visible damage, the other party might still try to make a claim. That’s why it’s essential to gather evidence, report the incident to your insurance company, and ensure they know the situation. Insurance companies will typically require proof of any damage before making any payments.

What if the other driver refuses to exchange insurance information?

If the other driver refuses to provide their insurance details, stay calm and politely ask again. If they continue to refuse, document their behavior, take photos of their vehicle and license plate, and report the situation to your insurance company and the police. This will create a record of your attempt to handle things properly.

Should I admit fault if I’m unsure what happened?

No, you should never admit fault at the scene, especially if you’re unsure what happened. Stick to the facts when discussing the incident, and let your insurance company determine the fault after reviewing all the evidence.

Can my insurance rates increase even if I didn’t cause the accident?

Your insurance rates could increase even if you’re not at fault, depending on your insurance provider’s policies. However, thoroughly documenting the incident and showing evidence of your innocence can help your case, and your insurer will investigate the claim to avoid wrongful charges.

How do I get footage from a security camera?

If you spot a security camera near the scene, you’ll need to contact the camera’s owner—this could be a business, a homeowner, or even the city if it’s a traffic camera. Explain the situation and request access to footage that might have captured the incident. Sometimes, you might need legal assistance or a formal request to obtain the footage.

What happens if I don’t report the incident to my insurance company?

Failing to report the incident to your insurance company could complicate things if the other party files a claim later. Even if the claim is false, your insurer may be less prepared to defend you if they aren’t notified promptly. It’s always best to inform them, even if you believe the situation is minor or baseless.

Do I need a lawyer for every false claim?

Not necessarily. Your insurance company can often handle false claims on your behalf. However, if the situation escalates—such as the other party filing a lawsuit or your insurance company advising legal action—it’s wise to consult a lawyer to help protect your rights.

Can installing a dash cam help in these situations?

Yes, having a dash cam can be incredibly helpful. It provides real-time footage of your driving and can capture the exact moment of the alleged incident. If someone falsely claims you hit their car, dash cam footage can quickly clear up misunderstandings or show that you weren’t involved.

What if the other driver threatens me?

If you ever feel threatened by the other driver, prioritize your safety. Try to remove yourself from the situation, call the police, and document any threatening behavior. It’s important not to engage in arguments or confrontations, especially if the other party becomes aggressive.

Glossary

Accusation: A claim that someone has done something wrong, such as causing damage in a car accident, often requiring investigation and evidence to prove or disprove.

Dash Cam: A camera mounted on a vehicle’s dashboard that continuously records footage while driving. Useful in documenting incidents like accidents or false claims.

Documentation: The process of collecting and recording evidence, such as photos, videos, and witness statements, to support your version of events in case of a dispute or legal matter.

Evidence: Any material, such as photos, videos, or witness statements, that helps to prove or disprove a claim or accusation in a legal or insurance-related matter.

False Claim: An accusation that is untrue or inaccurate, such as someone wrongly claiming you hit their car, often requiring defense with proper evidence.

Fraud: The deliberate act of deceiving someone for financial gain, such as filing a false insurance claim for damages that didn’t occur.

Insurance Fraud: A crime where a person attempts to receive compensation from an insurance company through dishonest means, such as falsely accusing someone of causing damage.

Insurance Provider: A company that offers insurance policies to protect against various risks, such as accidents or damages, and handles claims when incidents occur.

Legal Action: The process of taking a dispute to court for resolution, which may happen if someone makes a false claim against you and seeks compensation through legal channels.

Liability: Legal responsibility for something, such as causing damage in a car accident. If falsely accused, you may need to defend against liability claims.

Report: The act of informing your insurance company or authorities about an incident, such as a car accident or false claim, to ensure a record of the event is made.

Security Cameras: Cameras installed in public or private locations that record footage, often used as evidence in situations like traffic accidents or false claims.

Settlement: An agreement between parties to resolve a claim, often involving compensation, without going to court. In cases of false claims, you should avoid agreeing to settlements before consulting your insurance or lawyer.

Surveillance Footage: Video recordings from security or dash cams that can be used as evidence in an investigation, such as proving or disproving a false claim.

Witness: A person who observes an event, such as a car accident, and can provide an impartial account of what happened. Witness statements can be crucial in defending against false claims.

Additional Resources for You

For those navigating the complexities of legal disputes or seeking justice and compensation for injuries, our lead attorney, Molly Rosenblum Allen, Esq., has developed a suite of resources tailored to meet your needs during challenging times. With her extensive experience and dedication to serving the community, she has created the following guides and services to assist you:

Las Vegas Personal Injury Attorney: Comprehensive support for individuals suffering from injuries due to the negligence of others. Learn more.

Las Vegas Car Accident Attorney: Effective legal representation for victims of car accidents, ensuring they receive the compensation they deserve. Discover how we can help.

Motorcycle Accident Lawyer Las Vegas: Specialized legal assistance for motorcycle accident victims, addressing the unique challenges they face. Find out more.

Wrongful Death Lawyer Las Vegas: Compassionate support and legal guidance for families dealing with the loss of a loved one due to wrongful death. Explore our services.

Truck Accident Attorney Las Vegas: Dedicated representation for individuals involved in truck accidents, helping navigate the complexities of these cases. Get more information.

Las Vegas Drunk Driving Accident Attorney: Advocacy and support for victims of drunk driving accidents, aiming to hold responsible parties accountable. Learn how we can assist.

Las Vegas Slip and Fall Attorney: Effective legal advice for slip and fall accident victims, ensuring they understand their rights and options. Find out how we can help.

Molly Rosenblum Allen, Esq., and the team at The Rosenblum Allen Law Firm are committed to providing the highest quality legal services to ensure your rights are protected and you achieve the best possible outcome in your case.

Outside Resources for You

American Bar Association (ABA): A rich source of legal resources, including public education information and directories of legal professionals across the United States. Visit ABA.

National Highway Traffic Safety Administration (NHTSA): Offers extensive resources on road safety, accident prevention, and the legal obligations of drivers. Explore NHTSA.

United States Courts: Provides insight into the federal judiciary system, offering resources for understanding how courts operate and legal terminology. Check out United States Courts.

FindLaw: A comprehensive legal website offering a wealth of information on state-specific laws, legal topics, and how to find legal assistance. Discover FindLaw.

Avvo: An online legal services marketplace that provides lawyer referrals and access to a database of legal advice from attorneys across various law fields. Learn more at Avvo.

Justia: Offers free case law, codes, regulations, legal articles and legal blog databases, as well as community forums. Visit Justia.

NOLO: A long-standing provider of legal information and products for consumers and businesses, helping to demystify the law with straightforward articles and guides. Explore NOLO.

A Special Message from Our Lead Attorney, Molly Rosenblum Allen, Esq

Dear Reader,

Thank you for taking the time to engage with our resources. I hope you found them informative and empowering as you navigate your situation. Understanding your rights and options is the first step toward achieving your desired outcome.

If you’re ready to take action and want personalized guidance and support, my team and I are here to help. You can reach us at (702) 433-2889 to discuss how we can assist you in moving forward with your case.

We’re committed to providing you with the high-quality legal assistance you need. Let’s get the ball rolling on resolving your situation.

Warm regards,

Molly Rosenblum Allen, Esq.