Estate planning is the process of organizing your financial and personal affairs to ensure that your wishes are honored when you are no longer able to manage them yourself.

It involves creating legal documents to:

- Distribute your assets to loved ones or charities.

- Designate who will make decisions on your behalf.

- Plan for healthcare preferences and end-of-life care.

At its core, estate planning is about giving you control over your legacy and providing peace of mind for your family.

Why Estate Planning Is Important for Seniors

For seniors, estate planning becomes especially crucial. Here’s why:

- Preserving Financial Security: Ensures your money is managed wisely to support your needs and those of your beneficiaries.

- Reducing Family Conflicts: Clearly outline your intentions to prevent misunderstandings or disputes among family members.

- Avoiding Probate: Helps your loved ones bypass the lengthy and expensive probate process.

Taking the time to plan can protect both your assets and your family’s future.

Common Myths About Estate Planning

Many people have misconceptions about estate planning. Let’s debunk a few:

| Myth | Reality |

|---|---|

| Estate planning is only for the wealthy. | Anyone with assets—big or small—can benefit from estate planning. |

| Estate plans are permanent. | Plans can and should be updated as life circumstances change. |

| Estate planning is too expensive. | There are options for every budget, from DIY tools to working with professionals. |

Understanding the truth behind these myths can encourage seniors to take the first steps toward estate planning.

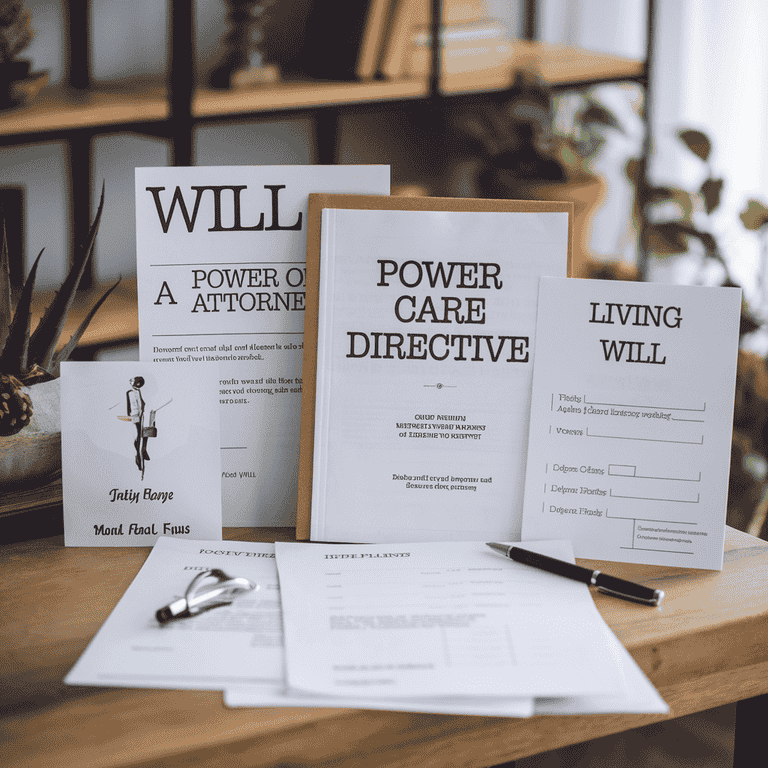

Essential Estate Planning Documents

Last Will and Testament

The Last Will and Testament is often the cornerstone of any estate plan.

- Purpose: Specifies how your assets will be distributed and who will care for minor children.

- Choosing an Executor: Select a trusted individual or institution to fulfill your wishes.

| Pros of Having a Will |

|---|

| Ensures your wishes are followed. |

| Simplifies the process for your loved ones. |

| Provides clarity on who inherits what. |

Living Trust

A Living Trust is another powerful estate planning tool.

- Benefits: Allows assets to pass directly to beneficiaries without probate.

- Differences from a Will: While a will takes effect after you pass, a living trust becomes active while you’re still alive.

| Will vs. Living Trust |

|---|

| A will goes through probate. |

| A will covers all assets. |

Power of Attorney

This document grants someone the authority to make decisions on your behalf.

- Financial Power of Attorney: Allows someone to handle your financial matters, like paying bills or managing investments.

- Healthcare Power of Attorney: Appoints someone to make medical decisions for you if you’re unable to.

Advance Healthcare Directive

Advance healthcare directives ensure your medical preferences are respected if you cannot speak for yourself. These documents cover critical aspects of healthcare decisions and can provide clarity during difficult times.

Living Will Explained

A living will spell out the medical treatments you want or don’t want. This can include:

- Life-sustaining treatments, like ventilators.

- Resuscitation preferences (Do Not Resuscitate orders).

- Pain management and comfort care.

Having a living will take the guesswork out of difficult decisions for your loved ones.

Naming a Healthcare Proxy

A healthcare proxy is someone you trust to make medical decisions for you. This could be a family member, close friend, or another trusted person.

When selecting a healthcare proxy, consider someone who:

- Understand your values and wishes.

- Can handle high-pressure situations.

- Is willing and able to advocate for you.

You create a robust plan for managing your healthcare needs by combining a living will and a healthcare proxy.

Beneficiary Designations

Beneficiary designations determine who receives specific assets after you pass. This applies to accounts like:

- Life insurance policies.

- Retirement accounts (401(k), IRA).

- Payable-on-death (POD) bank accounts.

Importance of Updating Beneficiaries

Outdated beneficiary information can lead to legal headaches. For example:

- An ex-spouse may still be listed as a beneficiary.

- A deceased individual may be named, creating confusion.

Review and update beneficiary designations regularly, especially after life changes like marriage, divorce, or child birth.

Accounts That Require Beneficiary Designations

| Account Type | Beneficiary Requirement |

|---|---|

| Life Insurance Policies | Required at setup. |

| Retirement Accounts | Required at setup. |

| Investment Accounts | Optional, but recommended. |

Keeping beneficiary information accurate is a small step that makes a big difference for your loved ones.

Key Considerations for Seniors in Estate Planning

Assessing Assets and Liabilities

Start with an honest inventory of your financial situation. This helps ensure no assets are overlooked and all debts are accounted for.

Creating an Inventory of Assets

List everything you own, including:

- Real estate: Homes, land, or vacation properties.

- Financial accounts: Checking, savings, and investments.

- Personal property: Jewelry, vehicles, and collectibles.

Identifying Debts and Liabilities

Note all outstanding obligations, such as:

- Mortgages or home equity loans.

- Credit card debt.

- Medical bills.

Organizing this information ensures your estate plan is complete and well-structured.

Planning for Long-Term Care

Long-term care planning is essential for seniors. The cost of care can deplete savings without a solid plan.

Medicaid Planning

Medicaid can help cover nursing home costs, but eligibility rules are strict. Strategies include:

- Spending down assets within legal limits.

- Setting up irrevocable trusts to protect assets.

Options for Long-Term Care Insurance

Insurance can offset in-home care, assisted living, or nursing home costs. Policies vary, so look for the following:

- Coverage for different types of care.

- Flexible benefit periods.

- Premiums that fit your budget.

Investing in long-term care planning ensures you receive quality care without financial strain.

Addressing End-of-Life Wishes

Funeral and Burial Instructions

Planning for your funeral can ease the burden on your loved ones during a difficult time. It also ensures your wishes are honored.

Decisions to Include:

- Type of Service: Traditional funeral, memorial, or celebration of life.

- Burial Preferences: Burial, cremation, or other methods.

- Details: Location, music, readings, and speakers.

Writing these wishes down and sharing them with your family or attorney is key. You can even prepay for services to relieve financial stress on your loved ones.

Legacy Planning

Legacy planning allows you to leave a meaningful impact beyond your material possessions. This can involve:

- Creating a Charitable Fund: Donate to causes you care about.

- Recording Memories: Write letters or record videos for loved ones.

- Passing Down Family Heirlooms: Ensure special items go to specific individuals.

Legacy planning makes your estate plan personal and deeply meaningful.

Involving Family Members

Family involvement is a crucial part of estate planning. Open communication helps prevent misunderstandings and ensures everyone is on the same page.

Holding Family Meetings

Bring your family together to discuss your plans. Topics to cover include:

- Who will serve as executor or trustee?

- Your healthcare and financial preferences.

- Any special provisions for specific family members.

Being transparent fosters trust and reduces potential conflicts.

Avoiding Misunderstandings

Even the best-laid plans can cause disagreements if not communicated well. Steps to minimize this include:

- Sharing why certain decisions were made.

- Provide a written summary of your plan.

- Allowing space for questions and clarifications.

Engaging your family early strengthens relationships and aligns everyone with your wishes.

Legal and Tax Implications

Avoiding Probate

Probate is the legal process of settling your estate after you pass. It can be costly and time-consuming, but careful planning can minimize or avoid it.

What Probate Involves:

- Validating your will.

- Appointing an executor.

- Distributing assets to beneficiaries.

Strategies to Bypass Probate:

| Method | Benefit |

|---|---|

| Living Trust | Assets transfer directly to beneficiaries without probate. |

| Joint Ownership | Property passes to the co-owner automatically. |

| Payable-on-Death Accounts | Funds go directly to the named beneficiary. |

Avoiding probate saves time and money while simplifying the process for your loved ones.

Understanding Estate Taxes

Estate taxes are an essential consideration for seniors with significant assets. While many estates won’t owe federal taxes, it’s still worth understanding the rules.

Federal Estate Tax Exemptions

As of 2024, estates valued under $12.92 million are exempt from federal taxes. Couples can effectively double this exemption with proper planning.

State-Level Tax Considerations

Some states impose their own estate or inheritance taxes, which may have lower exemptions. Check your state’s rules to ensure compliance.

Protecting Assets from Creditors

Ensuring your beneficiaries receive their inheritance without interference from creditors is essential.

Use of Trusts for Asset Protection

Irrevocable trusts are a standard tool for shielding assets. Once assets are placed in the trust, they are no longer considered part of your estate.

Legal Safeguards

Other strategies include:

- Titling assets in ways that protect them.

- Purchasing liability insurance to reduce risks.

Proper asset protection ensures your loved ones benefit fully from your estate.

Reviewing and Updating an Estate Plan

When to Review an Estate Plan

Life changes, and so should your estate plan. Regular reviews ensure it still reflects your wishes and circumstances.

Key Times to Revisit Your Plan:

- Family Changes: Marriage, divorce, birth, or death in the family.

- Financial Shifts: Gaining or losing significant assets.

- Health Changes: Diagnoses or developments affecting long-term care.

- Legal Updates: Changes in tax laws or estate planning regulations.

A good rule of thumb is to review your estate plan every three to five years or whenever a significant life event occurs.

How to Update an Estate Plan

Updating your plan can be simple with the right approach.

Steps to Take:

- Identify Necessary Changes: Make a list of outdated information or new wishes.

- Consult an Attorney: Ensure changes comply with current laws.

- Revise Documents: Update wills, trusts, or directives as needed.

- Notify Key People: Inform family members, executors, and proxies of updates.

Keeping your plan current prevents unnecessary complications later.

Seeking Professional Help

Working with an Estate Planning Attorney

An experienced attorney is invaluable in creating a thorough and legally sound estate plan.

Benefits of Hiring an Attorney:

- Personalized Guidance: Tailored solutions for your unique situation.

- Compliance with Laws: Ensures your plan adheres to state and federal regulations.

- Error Prevention: Reduces risks of disputes or invalid documents.

When selecting an attorney, look for someone who specializes in estate planning and has a good reputation.

Using Financial Advisors and Tax Experts

Financial advisors and tax professionals can complement your estate planning efforts.

How They Can Help:

- Financial Advisors: Assist with investment strategies, retirement planning, and asset allocation.

- Tax Experts: Minimize tax liabilities for you and your beneficiaries.

Working with a team of professionals creates a well-rounded and effective estate plan.

Preparing for the Future

Organizing and Safeguarding Important Documents

Keeping your documents organized ensures they are accessible when needed.

Key Documents to Safeguard:

- Wills and trusts.

- Powers of attorney.

- Advance healthcare directives.

- Property deeds and financial account details.

Tips for Safe Storage:

- Use a fireproof and waterproof safe.

- Share access with trusted family members or your attorney.

- Consider digital backups in secure, encrypted storage.

Being prepared can make a challenging time more manageable for your loved ones.

Communicating Your Plan

Open communication with family members and those involved in your estate plan is essential.

Topics to Discuss:

- Your wishes and why you made certain decisions.

- Roles and responsibilities of executors and proxies.

- How to access your important documents.

Tools for Clear Communication:

- Family meetings to review the plan.

- Written summaries of your wishes.

- Letters to loved ones explaining your intentions.

Effective communication can prevent confusion and foster understanding among your loved ones.

Common Mistakes in Estate Planning

Procrastination

One of the most common mistakes is waiting too long to start estate planning. Life is unpredictable, and delaying can leave your loved ones unprotected.

Why People Procrastinate:

- They feel estate planning is overwhelming.

- They believe they don’t have enough assets.

- They think they have plenty of time.

The Consequences of Waiting:

- Family disputes over unclear wishes.

- Assets tied up in lengthy probate.

- Loss of opportunities to minimize taxes.

Starting early gives you peace of mind and ensures your family is cared for.

Not Updating the Plan

Outdated estate plans can lead to unintended consequences.

Common Triggers for Updates:

- Divorce or remarriage.

- Birth of new grandchildren.

- Significant financial gains or losses.

You need to update your plan to avoid assets going to the wrong people or missing out on tax benefits. Regular reviews are essential.

Questions to Ask an Estate Planner

Essential Questions

When working with an estate planner, it’s essential to ask the right questions to ensure they’re the right fit and your plan is comprehensive.

Key Questions to Ask:

- How much experience do you have with estate planning?

- Are you familiar with state-specific laws?

- What are your fees, and what do they cover?

- Can you help minimize estate and inheritance taxes?

- How often should I review my plan with you?

The answers to these questions will help you find a professional who understands your needs.

Questions About Specific Needs

If your situation includes unique circumstances, ask targeted questions.

Examples:

- Do you have experience creating trusts for special needs dependents?

- Can you assist with Medicaid planning for long-term care?

- What strategies can protect my small business or family farm?

The more specific your questions, the better your estate planner can tailor their advice.

Tools and Resources for Estate Planning

Online Tools

Online tools can simplify some aspects of estate planning, especially for straightforward cases.

Popular Options:

| Tool Type | Features | Example Services |

|---|---|---|

| Will Makers | Create basic wills online. | LegalZoom, Nolo |

| Trust Management | Set up and manage living trusts. | Trust & Will |

| Document Storage | Securely store estate planning docs. | Everplans, My Life & Wishes |

While online tools are convenient, they’re best for basic needs. Complex situations benefit from professional guidance.

Local and National Resources

Many organizations offer valuable resources for seniors and their families.

Helpful Resources:

- American Bar Association: Offers free legal guides for estate planning.

- AARP: Provides articles and tools tailored to seniors.

- State Legal Aid Offices: Free or low-cost legal services for seniors.

Combining professional help with these resources ensures you’re well-equipped to create a solid estate plan.

Planning for Long-Term Care

Considering Long-Term Care Options

Long-term care is an essential part of estate planning. It involves planning for services you might need as you age, such as help with daily activities or medical care.

Types of Long-Term Care:

| Type | Description | Examples |

|---|---|---|

| In-Home Care | Assistance provided in your home. | Personal aides, meal delivery. |

| Assisted Living | Residential care with support services. | Help with grooming, housekeeping. |

| Nursing Homes | Facilities with 24/7 medical care. | Skilled nursing, therapy. |

| Continuing Care Communities | Combines multiple levels of care in one location. | Independent living to full nursing care. |

Knowing your preferences in advance can make these decisions easier for you and your family.

Financing Long-Term Care

Long-term care can be expensive. Planning for costs ahead of time protects your savings and reduces stress for loved ones.

Common Ways to Pay:

- Savings: Set aside funds specifically for care.

- Long-Term Care Insurance: Covers services not typically included in health insurance.

- Medicaid: A safety net for those with limited assets but comes with strict eligibility requirements.

- Veterans Benefits: For eligible veterans and their spouses.

Cost-Saving Tips:

- Start planning early.

- Explore community resources and government programs.

- Consider hybrid insurance policies that combine life and long-term care coverage.

Wrapping Up Your Estate Plan

Why Estate Planning Matters

Estate planning is more than just writing a will. It’s about creating security and ensuring your wishes are followed.

Benefits of a Thoughtful Estate Plan:

- Reduces stress for your family.

- Protects your assets from unnecessary taxes or disputes.

- Ensures your healthcare and financial decisions reflect your values.

Taking action now can save your loved ones from challenges later.

Taking the First Step

Starting your estate plan doesn’t have to be overwhelming. Break it down into simple steps:

- Write down your goals and wishes.

- Gather important documents.

- Meet with an estate planning professional.

Your loved ones will thank you for planning ahead. It’s a gift that provides clarity and peace of mind for everyone involved.

Breaking it down

Estate planning for seniors is about more than just writing a will—it’s about creating a legacy of care, protection, and clarity for your loved ones. By planning, organizing, and communicating your wishes, you can ensure that your estate is handled according to your values, while minimizing stress and confusion for your family.

Remember, estate planning is not a one-time task but an ongoing process that evolves with your life. Staying proactive is key, whether it’s through regular reviews, updating your documents after significant events, or seeking professional guidance.

Start today by taking small steps—write down your goals, gather your documents, and consult an expert. Your future self—and your loved ones—will thank you for it. Planning isn’t just a gift; it’s peace of mind for you and your family.

If you’re ready to start or update your estate plan, don’t hesitate to contact an experienced estate planning attorney who can guide you every step.

Frequently Asked Questions

What is the difference between a will and a trust?

A will is a legal document that specifies how you want your assets distributed after death. It goes through the probate process, which can be time-consuming and costly. On the other hand, a trust is a legal entity that holds and manages your assets. It can help avoid probate, provide privacy, and potentially reduce estate taxes. Trusts are often more flexible and can address complex situations, such as caring for a minor child or a special needs dependent.

Do I need an estate plan if I don't have many assets?

Yes, even if you don’t have a large estate, an estate plan can still be beneficial. It ensures that your assets are distributed according to your wishes and can help avoid conflicts among family members. Furthermore, an estate plan allows you to name guardians for minor children, assign healthcare proxies, and make end-of-life decisions clear, regardless of asset size.

How can I reduce estate taxes through my estate plan?

Various strategies to minimize estate taxes include creating trusts, gifting assets while alive, and utilizing tax exemptions. Certain types of trusts, like irrevocable life insurance trusts or charitable remainder trusts, can remove assets from your taxable estate, reducing the estate tax burden. Consulting with an estate planning attorney and tax professional will help you determine the most effective strategy based on your unique situation.

What happens if I die without an estate plan?

If you die without an estate plan, your assets will be distributed according to state law, which may not align with your wishes. The court will appoint a probate judge to oversee the distribution of your estate, and this process can be time-consuming and expensive. Additionally, if you have minor children, the court will decide who will be their guardian.

Can I make changes to my estate plan after it’s been completed?

You can change your estate plan anytime, as long as you are mentally competent. Modifications may be needed after significant life events like marriage, divorce, or the birth of a child. These changes can be made through amendments (codicils) for a will or trust amendments for trusts. Consult with an estate planning professional to ensure any updates are legally valid.

How can I ensure that my healthcare wishes are followed if I become incapacitated?

You can ensure your healthcare wishes are followed by creating an advance healthcare directive (also known as a living will) and a healthcare power of attorney. The directive outlines your medical treatment preferences in case you cannot communicate. At the same time, the healthcare power of attorney designates someone to make medical decisions if you are incapacitated.

Should I update my estate plan after a divorce?

Yes, updating your estate plan after a divorce is crucial. You may want to remove your former spouse as a beneficiary or executor and designate new individuals for these roles. Divorce can significantly change your financial situation, and updating your plan ensures your assets are distributed according to your new wishes.

What is a healthcare proxy, and why is it important?

A healthcare proxy is a person you designate to make medical decisions on your behalf if you cannot do so. This ensures that someone you trust will carry out your healthcare wishes. It’s an important part of planning for future health issues, especially for seniors who may need assistance with healthcare decisions.

Can I make my estate plan legally binding without an attorney?

While creating basic estate planning documents on your own using online services or templates is possible, it’s generally advisable to work with an attorney. A professional ensures that your documents are legally valid, tailored to your unique needs, and compliant with state laws. Having an attorney helps prevent common mistakes that can invalidate your estate plan or cause confusion among your heirs.

What happens if I don't name my retirement accounts or life insurance beneficiaries?

If you don’t name a beneficiary for your retirement accounts or life insurance, the account or policy proceeds may be paid out according to the plan’s or insurance policy’s default provisions. This can often mean the proceeds are subject to probate and distributed according to the state’s laws of intestacy, which may not align with your wishes. It’s always best to regularly update beneficiary designations to ensure they match your estate plan.

How does a living trust work?

A living trust is a legal document that places your assets into a trust during your lifetime. You act as the trustee, meaning you retain control over your assets. Upon death or incapacitation, a designated successor trustee distributes your assets according to your instructions. A living trust helps avoid probate, ensures privacy, and can be structured to provide ongoing care or benefits for loved ones.

What is probate, and how does it affect my estate?

Probate is the legal process through which a deceased person’s will is validated, and their assets are distributed. It involves court supervision and can be time-consuming, expensive, and public. Assets that aren’t part of a trust and don’t have designated beneficiaries must go through probate. Avoiding probate is one of the key benefits of establishing a trust.

Can I leave assets to a charity in my estate plan?

You can leave assets to a charity as part of your estate plan. This can be done through a will or a trust, providing significant tax benefits. Charitable donations can also be included in strategies to reduce estate taxes, such as through charitable remainder trusts, which provide both a benefit to the charity and a stream of income to you during your lifetime.

Additional Resources for You from The Rosenblum Allen Law Firm.

As you navigate through the estate planning process, it’s important to remember that our lead attorney, Molly Rosenblum Allen, Esq., has created several other helpful resources designed to assist you during this time. These resources provide valuable insights and guidance on various aspects of estate planning, helping ensure your future and your loved ones are taken care of.

Here are some additional resources created by Molly Rosenblum Allen, Esq. to guide you:

- Las Vegas Estate Planning Attorney: Comprehensive information about estate planning services and how our attorneys can help protect your assets.

- Las Vegas Trust Attorney: Learn about trust services and how a trust can help secure your assets and avoid probate.

- Tips on Estate Planning: Practical tips to help you start and organize your estate planning journey.

- Estate Planning Checklist: A checklist to ensure you’re covering all the important steps in your estate planning process.

- Making a Will: Information about creating a will, including important considerations and how it works in your estate plan.

- Estate Planning Services: Details on the comprehensive estate planning services we offer to meet your needs.

- Estate Planning Mistakes: A guide to common estate planning mistakes and how to avoid them to ensure your wishes are honored.

- Estate Planning Probate: Learn about the probate process and how estate planning can help you avoid or streamline it.

- Las Vegas Asset Protection Attorney: Information on how to protect your assets and wealth for future generations.

These resources can provide the additional guidance you need to make informed decisions and ensure your estate plan is complete and effective.

Offsite Resources for You

- American Bar Association (ABA) – https://www.americanbar.org: Offers various resources on estate planning, legal tools, and finding legal professionals in your area.

- AARP – Estate Planning – https://www.aarp.org: A comprehensive resource with tips and guides specifically for seniors on managing estate planning.

- National Estate Planning Council – https://www.nepconline.org: Provides educational resources and professional connections for those seeking estate planning assistance.

- Estate Planning Council – https://www.estateplanningcouncil.org: A network of estate planning professionals offering tools and information on trusts, wills, and more.

- National Association of Elder Law Attorneys (NAELA) – https://www.naela.org: Provides resources and a directory to help you find elder law attorneys specializing in estate planning and asset protection.

- Trust & Estates – https://www.trustestates.com: Offers articles, resources, and updates on the latest trends and legal changes related to trusts and estates.

- The Balance – Estate Planning – https://www.thebalance.com/estate-planning-4073993: A helpful guide to understanding the basics of estate planning and other important legal and financial considerations.

A Special Message from Our Lead Attorney, Molly Rosenblum Allen, Esq

Thank you for taking the time to read through these resources. I hope you found the information helpful as you navigate your estate planning journey. If you’re ready to take the next step or have any questions about your specific situation, my team and I are here to help.

Feel free to give us a call at (702) 433-2889 to get the ball rolling. We’re ready to guide you through the process and ensure your future and your loved ones are protected.

Warm regards,

Molly Rosenblum Allen, Esq.