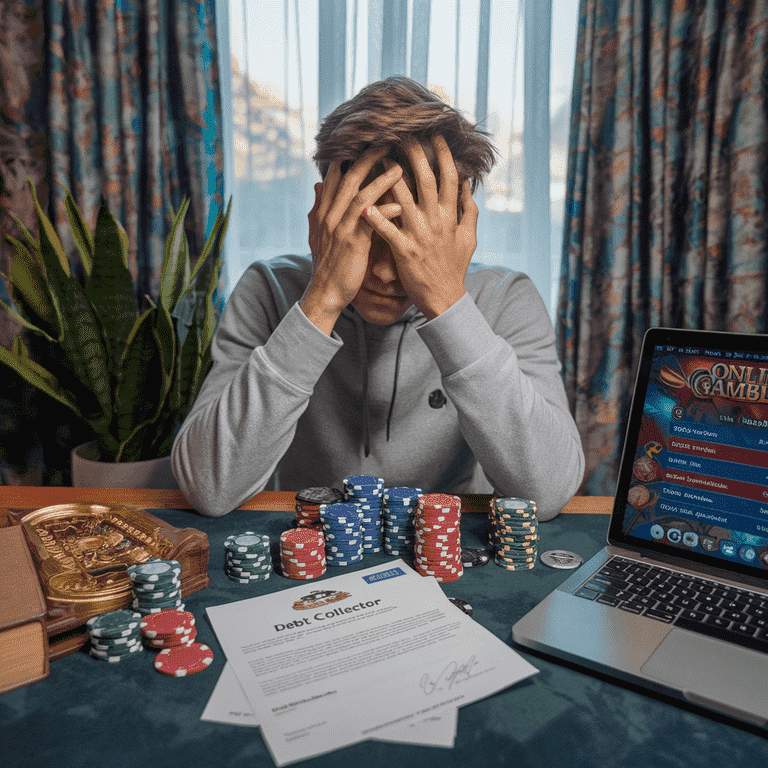

Las Vegas is famous worldwide for its casinos and entertainment, attracting millions of visitors eager to test their luck. However, things can get complicated quickly when the chips run out and debts remain. Gambling debt collections are a serious issue for both locals and tourists.

Understanding the legal implications of unpaid gambling debts and potential criminal charges is crucial for anyone who plays in Las Vegas. This guide will walk you through everything you need to know about gambling debt collection charges in Las Vegas, helping you avoid legal trouble or find solutions if you’re already in a tough spot.

Gambling Debt Collection Laws in Las Vegas

Overview of Nevada State Laws Related to Gambling Debts

In Nevada, gambling debts are legally enforceable, unlike in many other states where such debts are considered unenforceable “moral obligations.” Under Nevada law, casinos have the legal right to collect unpaid gambling debts through the courts, just like any other creditor.

Casinos often issue what are known as “credit markers,” which are essentially loans used to gamble. If these markers aren’t repaid, the casino can pursue legal action.

Essential Nevada Gambling Debt Laws:

- Nevada Revised Statutes (NRS) 463.368: This law allows casinos to offer credit to gamblers and outlines their rights to collect debts.

- NRS 205.130: Makes it a crime to write bad checks, including unpaid casino markers.

The Nevada Gaming Control Board also regulates casinos, ensuring they follow proper collection procedures. If a casino doesn’t, it could face penalties.

Federal Laws That May Apply to Gambling Debt Collections

In addition to state laws, some federal laws may impact how gambling debts are collected, especially when third-party debt collectors get involved.

The Fair Debt Collection Practices Act (FDCPA) protects consumers from abusive debt collection practices. This means that even if you owe a gambling debt, third-party collectors must follow strict rules when trying to collect that debt.

What Constitutes Gambling Debt in Las Vegas

Definition and Types of Gambling Debt

Gambling debts come in various forms, and it’s essential to understand the different types to know what you’re up against. These can include:

- Casino credit markers: Formal loans issued by casinos to gamblers.

- IOUs or informal agreements: Often between private parties during poker games or other informal gambling settings.

- Online gambling debts: Debts accumulated through online gambling platforms, which may have different enforcement rules depending on the jurisdiction.

Credit Marker Agreements

Casinos often issue credit markers, which are similar to a check. These markers are an agreement to repay the casino within a set period, usually 30 days. If the debt isn’t repaid within that time, the casino can cash the marker just like a check.

Repayment Terms and Conditions

When accepting credit markers, gamblers must sign an agreement outlining the repayment terms. This agreement will include:

- The total credit amount

- The due date for repayment

- Any applicable interest or fees for late payment

As detailed in later sections, failing to repay a marker can lead to civil lawsuits and even criminal charges.

Differences Between Formal and Informal Gambling Debts

While formal gambling debts, such as casino markers, are enforceable in court, informal gambling debts, like IOUs between friends, may not be. Informal debts often rely on trust; enforcing them through the legal system can be difficult. However, if the debt involves fraud or deceit, it could have legal consequences.

The Gambling Debt Collection Process

Initial Steps Casinos and Lenders Take to Collect Debts

Casinos typically start by attempting to collect unpaid debts internally. The first few steps often include:

- Reminder calls and letters: The casino will reach out to remind you of the unpaid debt.

- Formal demand letters: A more severe letter stating the debt amount and potential legal consequences if unpaid.

Casinos tend to be patient at first but will escalate the process if you don’t respond or make payment.

What Happens if You Don’t Pay a Gambling Debt

If initial efforts to collect the debt fail, the casino may take more aggressive action:

- Civil lawsuits: The casino can sue you in court to recover the debt. If they win, they may obtain a judgment to garnish your wages or place a lien on your property.

- Reporting to credit agencies: Unpaid debts can be reported to credit agencies, damaging your credit score.

The Role of Third-Party Debt Collectors

If a casino fails to collect the debt, it may turn the account over to a third-party debt collector. While third-party collectors are legally permitted to attempt collections, they must follow the FDCPA, which prohibits:

- Harassment or abuse

- Deceptive or unfair practices

- Calling at inappropriate times (such as before 8 a.m. or after 9 p.m.)

FDCPA Protections in Gambling Debt Collections

The FDCPA provides several critical protections for consumers facing gambling debt collections. These include:

- The right to request written verification of the debt

- The right to dispute the debt

- The right to stop all communication from the collector (except to inform you of legal action)

Criminal Charges Related to Gambling Debt Collections

When Gambling Debt Can Lead to Criminal Charges

One of the most surprising facts for many people is that unpaid gambling debts can sometimes lead to criminal charges in Las Vegas. While most debts are considered civil matters, certain types of unpaid gambling debts, especially casino credit markers, can cross over into the criminal realm.

This typically happens when a credit marker is not paid, which functions similarly to a check. In Nevada, the casino can attempt to cash it if you don’t pay a credit marker within the agreed time. If your bank account doesn’t have sufficient funds, the casino can report it as a bad check.

Bad Check (Credit Marker) Cases

Under Nevada law (NRS 205.130), knowingly writing a bad check is considered fraud. If you don’t pay your marker and the casino attempts to cash it without success, it could be considered fraudulent. At this point, what was once a civil debt can turn into a criminal matter.

A bad check case usually begins with the casino filing a complaint. From there, law enforcement may get involved. You could face criminal prosecution for fraud, which brings severe consequences.

Fraud Allegations Related to Gambling Debt

Fraud can also arise in other scenarios. This could be considered fraudulent if you knowingly obtained casino credit to avoid paying it back. Casinos may argue that you committed fraud by taking out credit without the means or intention to pay.

Fraud charges are no joke. They can lead to severe legal penalties, fines, and potential jail time.

Penalties and Legal Consequences of Unpaid Gambling Debt

Fines

If you are convicted of criminal charges related to unpaid gambling debt, fines can be one of the penalties. The fine can vary based on the severity of the debt and whether fraud or bad check charges are involved. These fines can be substantial and might be in addition to the original debt amount.

In some cases, fines may also include interest and fees charged by the casino. If the case has escalated to criminal court, court costs might also be added.

Jail Time

Unfortunately, unpaid gambling debts in Las Vegas can lead to jail time if criminal charges are filed and you’re convicted. If you are found guilty of issuing a bad check or committing fraud, you could face jail time as part of the sentencing.

For smaller debts, jail time may be minimal or even replaced with probation. However, for more severe debts or intentional fraud, sentences could range from a few months to several years, depending on the severity of the charges.

Probation and Parole

In some cases, you may not go to jail immediately, but probation or parole could be a part of your sentence. Probation allows you to stay out of jail if you meet certain conditions set by the court, such as repaying the debt and avoiding any further legal trouble.

Failing to meet these conditions could land you in jail or extend your probation period. Parole is typically reserved for those who have already served jail time but are released under specific conditions.

Defending Against Gambling Debt Collection Charges in Las Vegas

Common Defenses Against Gambling Debt Collections

If you’re facing legal action over a gambling debt, it’s essential to know your rights and possible defenses. Some common defenses include:

- Disputed debt amount: You may argue that the collected amount is incorrect or that you have already paid part or all of the debt.

- Improper collection practices: You may have a defense if the casino or a third-party collector violates state or federal debt collection laws.

- Lack of intent to defraud: In criminal cases, you can argue that there was no intent to defraud the casino when you signed the marker.

For example, if you were unaware your bank account didn’t have sufficient funds or if the marker was signed under duress or misunderstanding, these could be valid defenses.

Legal Defenses for Criminal Charges Arising From Gambling Debts

In cases where criminal charges are filed, there are specific defenses that a skilled attorney can use:

- Proving lack of criminal intent: One of the primary elements of fraud is intent. You might avoid a conviction if you can show that you didn’t intentionally try to defraud the casino.

- Negotiating repayment plans: Often, casinos would rather be repaid than pursue lengthy criminal cases. Sometimes, your lawyer can negotiate a repayment plan, which may lead to the charges being dropped or reduced.

- Using bankruptcy as a defense against civil collections: Bankruptcy can discharge some gambling debts. However, consulting with an attorney is essential, as not all debts may be eligible for discharge.

Legal Rights and Protections for Debtors

Consumer Protection Laws in Nevada for Gambling Debts

As a debtor in Nevada, you have certain rights regarding debt collection. Even if you owe gambling debts, creditors must follow the law. Some critical protections include:

- Nevada Constitution protects individuals from going to jail simply for owing a debt. However, as noted earlier, criminal charges can still arise from bad checks or fraud.

- Nevada debt collection laws: Casinos and other creditors must follow state regulations to treat debtors fairly and ethically. If they violate these laws, you may have legal recourse.

FDCPA and How It Applies to Gambling Debt Collectors

The Fair Debt Collection Practices Act (FDCPA) applies to third-party debt collectors, and it provides numerous protections for you:

- Right to dispute the debt: If you believe the debt is invalid, you can request verification from the collector. They must provide proof that the debt is legitimate.

- Protection against harassment: Debt collectors can’t harass you by calling at odd hours, threatening legal action they don’t intend to take, or using abusive language.

- Cease communications: You can request that a debt collector stop contacting you. They must comply, though they can still pursue legal actions to collect the debt.

Role of the Nevada Gaming Control Board in Debt Collections

The Nevada Gaming Control Board is crucial in regulating casinos and ensuring they follow the rules, including debt collections. If you believe a casino has violated debt collection laws, you can file a complaint with the Gaming Control Board, which may investigate and take action against the casino.

How to Resolve Gambling Debt Collections Without Legal Consequences

Practical Tips to Avoid Gambling Debt Collection Charges

While gambling can be a lot of fun, it’s essential to be mindful of your financial limits. Here are some practical tips to avoid ending up with gambling debt collection charges:

- Set a budget: Before you enter the casino, set a strict budget for how much you’re willing to lose. Never gamble with money you can’t afford to pay back.

- Avoid casino credit: Taking out a credit marker might seem easy to keep playing, but it can quickly become a severe financial burden. Avoid taking out casino credit altogether.

- Know when to stop: Gambling can be addictive. If you find it hard to stop, consider seeking help from gambling addiction resources like Gamblers Anonymous.

- Communicate with the casino: If you have trouble paying your debts, contact the casino early. They may be more willing to work with you if you’re proactive about repayment rather than waiting until they have to take legal action.

Options for Settling Gambling Debts Out of Court

If you’re already in debt, settling the matter outside court is often the best solution. Here are some common ways to resolve gambling debts:

- Negotiate a payment plan: Many casinos prefer to get their money back, even if it means working out a payment plan. You may be able to negotiate smaller monthly payments, especially if you’re upfront about your financial situation.

- Offer a lump-sum settlement: If you can access some funds but not the total amount, you could offer a lump-sum payment to settle the debt. This is when you agree to pay a portion of the debt in exchange for the creditor forgiving the rest.

- Seek help from a debt consolidation service: These services can combine multiple debts into one payment, possibly with lower interest rates. Some specialize in helping people manage gambling debts.

Table: Comparing Debt Settlement Options

| Settlement Option | Pros | Cons |

|---|---|---|

| Payment Plan | Easier to manage monthly payments | May take longer to pay off the debt |

| Lump-Sum Settlement | Can reduce the total amount owed | Requires access to cash |

| Debt Consolidation | Simplifies multiple debts into one payment | May involve fees and higher interest rates |

How Filing for Bankruptcy Affects Gambling Debt

While bankruptcy can discharge certain types of debt, gambling debt is often a grey area. It’s not impossible to have gambling debts discharged in bankruptcy, but courts may be more hesitant if they believe the debt was incurred recklessly.

- Chapter 7 bankruptcy: This type of bankruptcy wipes out most unsecured debts, including some gambling debts. However, if the court believes you took out casino credit without the intention to repay it, they may reject your request.

- Chapter 13 bankruptcy: In this case, you create a repayment plan over three to five years. Your gambling debts might be included in this plan, giving you more time to repay them.

Bankruptcy is a significant financial step and should only be considered a last resort. Always consult with a bankruptcy attorney before filing.

Potential Long-Term Impacts of Gambling Debt Collections

Impact on Your Credit Score and Financial Standing

Unpaid gambling debts can wreak havoc on your credit score. If a casino reports your unpaid debt to the credit bureaus, you may see a significant drop in your credit score, making it harder to:

- Take out loans

- Apply for credit cards

- Rent an apartment

In addition to hurting your credit score, unpaid debts can result in judgments or liens on your property. These actions can further damage your financial standing, making recovering even more difficult.

Long-Term Criminal Record Consequences

If your gambling debt results in criminal charges and a conviction, the long-term consequences can be severe. A criminal record can:

- Make it more challenging to find a job

- Limit your ability to rent or buy a home

- Affect your ability to obtain professional licenses

Even if you avoid jail time, the impact of a criminal record can follow you for years, creating barriers to a stable life.

The Emotional Toll of Unresolved Gambling Debt and Legal Charges

It’s not just about money. Unresolved gambling debt and legal issues can take a significant emotional toll. Many people experience stress, anxiety, and even depression as they try to deal with mounting debt and potential legal consequences.

If you’re feeling overwhelmed, consider seeking help from a therapist or counselor who specializes in financial or gambling issues. Support groups like Gamblers Anonymous can provide valuable guidance and emotional support.

Breaking It Down

Understanding gambling debt collection charges in Las Vegas is crucial if you’ve found yourself in debt due to gambling activities. The combination of civil and criminal consequences makes it vital to take these debts seriously.

However, legal protections, resources, and strategies can help you resolve these debts without causing lasting harm to your financial future or personal freedom.

If you’re dealing with gambling debt, don’t wait. Reach out for legal aid, explore settlement options, and get the help you need to manage both your debt and any underlying issues related to gambling. Being proactive can make all the difference in avoiding long-term damage and moving toward financial recovery.

By staying informed and taking the proper steps, you can manage your gambling debts responsibly and avoid the severe consequences that can arise in Las Vegas.

Frequently Asked Questions

How long must I repay a casino marker before it becomes a legal issue?

You usually have about 30 days to repay a casino marker in Las Vegas. If you don’t repay it within that time, the casino can attempt to cash the marker. If the payment doesn’t go through, the issue can escalate to legal action, including potential criminal charges for writing a bad check.

Can a casino garnish my wages if I don’t pay my gambling debt?

If the casino wins a civil lawsuit against you for unpaid gambling debt, they can obtain a judgment allowing them to garnish your wages. This means a portion of your paycheck could be automatically deducted to repay the debt.

Are online gambling debts treated the same as casino debts in Las Vegas?

Online gambling debts may be treated differently depending on where the gambling took place and the laws that apply to the specific platform. While Nevada law supports the enforcement of casino gambling debts, the enforceability of online gambling debts can vary depending on the jurisdiction.

What should I do if I’m being harassed by a debt collector over gambling debt?

If a debt collector harasses you, you have rights under the Fair Debt Collection Practices Act (FDCPA). This law prohibits debt collectors from using abusive, unfair, or deceptive practices. You can file a complaint, request they stop contacting you or even sue the collector if they violate your rights.

Can I settle a gambling debt for less than I owe?

Yes, in some cases, you can negotiate a settlement with the casino or debt collector to pay less than the total amount owed. Offering a lump-sum payment or working out a structured payment plan can reduce total debt. However, it’s best to consult a lawyer to ensure you get the best possible deal.

Can gambling debts be discharged in bankruptcy?

It’s possible to discharge gambling debts in bankruptcy, but it’s not guaranteed. The court may review how the debt was incurred and whether you intended to repay it. If the court determines that you took out credit recklessly or did not intend to repay it, the debt may not be discharged.

What happens if I ignore a gambling debt lawsuit?

If you ignore a lawsuit filed by a casino or creditor for unpaid gambling debt, the court will likely issue a default judgment against you. This means the casino automatically wins the case, and you could face wage garnishment, bank account levies, or liens on your property.

Can I represent myself in a gambling debt case?

While you have the right to represent yourself in court, it’s not always advisable, especially in cases involving gambling debt collections. A lawyer can help you understand the legal complexities, negotiate settlements, and provide a defense if criminal charges are involved.

What should I do if I receive a letter about a criminal case for unpaid gambling debt?

If you receive a letter indicating that criminal charges have been filed against you for unpaid gambling debt, you should contact a criminal defense attorney immediately. Criminal charges related to gambling debts can lead to severe penalties, including jail time, and it’s crucial to have legal representation to protect your rights.

Will my gambling debt affect my credit score?

Yes, unpaid gambling debts can be reported to credit agencies and negatively impact your credit score. A lower credit score can help you get loans and credit cards or even rent an apartment complex. It’s essential to address the debt before it reaches this point.

What’s the difference between civil and criminal gambling debt cases?

Civil gambling debt cases involve casinos or creditors suing you to recover the money you owe. Criminal cases typically arise when unpaid casino markers are treated as bad checks or fraudulent activity. Civil cases generally result in financial judgments, while criminal cases can lead to fines, probation, or jail time.

Can I negotiate with the casino before they take legal action?

Yes, you can and should attempt to negotiate with the casino before legal action is taken. Many casinos prefer to work out a payment plan rather than go through the time and expense of filing a lawsuit. Being proactive can often prevent a case from escalating to court.

What are my rights if I dispute a gambling debt?

If you dispute a gambling debt, you have the right to request verification of the debt from the creditor or collector.

Glossary

Casino Marker: A form of credit a casino extends to a gambler, similar to a check. It allows the gambler to play using funds borrowed from the casino, expecting the marker to be repaid within a certain period.

Civil Case: A legal dispute between two parties in which one party seeks to recover money owed or damages from the other. In the context of gambling debt, civil cases are filed by casinos to recover unpaid debts.

Credit Score: A numerical rating that reflects a person’s creditworthiness based on their financial history. Unpaid gambling debts reported to credit agencies can lower your credit score.

Debt Collection: The process by which creditors, including casinos, seek to recover money owed by individuals. This can include internal efforts by the creditor or hiring third-party agencies to collect the debt.

Default Judgment: A ruling issued by a court when the defendant (debtor) fails to respond to a lawsuit. In gambling debt cases, a default judgment can allow the creditor to garnish wages or seize assets.

Fair Debt Collection Practices Act (FDCPA): A federal law regulating third-party debt collectors’ practices. It protects consumers, including prohibitions on harassment and deceptive practices in debt collection.

Fraud: In the context of gambling debt, fraud typically refers to obtaining casino credit or signing a casino marker without the intention or ability to repay the debt.

Garnishment: A legal process that allows creditors to collect a portion of a debtor’s wages or bank account to satisfy a debt. This can occur if a casino wins a judgment in a civil case.

Judgment: A court decision that resolves a legal dispute. In gambling debt cases, a judgment in favor of the casino may allow for actions like wage garnishment or placing liens on property to recover the debt.

Lien: A legal claim placed on a debtor’s property (such as a home or vehicle) as security for paying a debt. If a casino wins a civil lawsuit for unpaid gambling debt, they may obtain a lien on your assets.

Lump-Sum Settlement: An agreement between a debtor and creditor where the debtor pays a portion of the debt in exchange for the creditor forgiving the remaining amount. This can be an option for resolving gambling debts out of court.

Nevada Gaming Control Board (NGCB): A regulatory body in Nevada responsible for overseeing the state’s gaming industry, including enforcing laws related to gambling debt collections.

Probation: A court-ordered period during which a person convicted of a crime can remain in the community under supervision rather than serving time in jail. Probation may be offered in cases involving criminal gambling debt charges.

Third-Party Debt Collector: A company or agency hired by a creditor, such as a casino, to recover unpaid debts. Third-party collectors must comply with the FDCPA when attempting to collect gambling debts.

Wage Garnishment: Deducting a portion of a debtor’s wages to repay a debt. This may occur if a casino wins a lawsuit against you for unpaid gambling debt and obtains a court order for garnishment.

Writ of Execution: A court order that allows a creditor to take specific actions, such as garnishing wages or seizing property, to satisfy a judgment in a debt case. Casinos may seek a writ of execution if they win a civil case for unpaid gambling debt.

Additional Resources for You

Molly Rosenblum, Esq., our lead attorney, has developed an extensive collection of resources tailored to address the intricacies and legalities surrounding gaming and gambling. These resources, accessible through the Rosenblum Law website, offer invaluable insights and legal guidance for individuals facing charges or seeking information on various aspects of gambling law. Whether you’re dealing with underage gambling, gambling debt collection crimes, or other gaming-related offenses, these resources are designed to assist and inform you during challenging times. Here’s a brief overview of the resources available:

Underage Gambling: Insightful guidance on the legal ramifications and defense strategies for underage gambling charges. Learn more about underage gambling.

- Gambling Violations: Comprehensive information on various gambling violations and the legal implications they carry. Explore gambling violations.

Marked Cards: Legal perspective and defense options for accusations involving the use of marked cards in gaming. Discover defenses for marked cards accusations.

Pinching Bets: Analysis and legal advice on pinching bets, a form of cheating in gambling. Learn about pinching bets.

Past Posting: Detailed exploration of past posting charges and effective defense strategies. Understand past posting and its defense.

Unlawful Acts Regarding Gaming Equipment: Legal guidance on charges related to the use or manipulation of gaming equipment. Explore unlawful acts regarding gaming equipment.

Sports Betting Fraud: Insights into the legal issues surrounding sports betting fraud and potential defense approaches. Learn about sports betting fraud.

Gaming Fraud Charges: Expert legal advice for those accused of gaming fraud, offering strategies for defense. Understand gaming fraud charges.

Through these meticulously prepared resources, Molly Rosenblum, Esq., aims to empower individuals with the knowledge and legal strategies necessary to navigate the complexities of gambling-related charges. We encourage you to utilize these resources, designed to provide support and guidance through your legal challenges.

Offsite Resources for You

Gamblers Anonymous

This is a support group for individuals struggling with gambling addiction. It offers meetings and resources for people seeking to recover from problem gambling, which can often lead to debt issues.

National Foundation for Credit Counseling (NFCC)

NFCC provides financial counseling, debt management plans, and advice on handling debts, including gambling-related ones. Their counselors can help create a plan to address debt and regain financial stability.

Fair Debt Collection Practices Act (FDCPA) – Federal Trade Commission (FTC)

The FTC provides valuable information about your rights under the FDCPA, including how to deal with debt collectors and protect yourself from unfair practices.

Money Management International (MMI)

MMI offers credit counseling and financial education, helping individuals manage their debts. Their services include debt management plans and support for those dealing with overwhelming gambling debts.

State Bar of Nevada

The State Bar of Nevada can help you find a qualified attorney who specializes in debt collection cases, including those related to gambling debts. Their lawyer referral service is a useful resource if you need legal help.

Consumer Financial Protection Bureau (CFPB)

The CFPB provides resources and tools for managing financial issues, including dealing with debt collectors and understanding your rights as a debtor.

American Bankruptcy Institute (ABI)

The ABI offers information on bankruptcy, which can be a last-resort option for those facing overwhelming gambling debts. Their resources help individuals understand bankruptcy laws and processes.

Why You Haven't Already Hired a Defense Attorney to Help You

Watch this short video to take the next big step toward defending your rights against your felony charge.

A Special Message from Our Lead Attorney

Molly Rosenblum

Dear Reader,

Thank you so much for taking the time to navigate through our resources on gambling debt collection crimes. I hope you’ve found the information insightful and helpful in understanding the complexities of this area of law.

Legal matters can be overwhelming, especially when they involve financial aspects such as gambling debts. Please remember you don’t have to face these challenges alone. I, along with my dedicated team at The Rosenblum Allen Law Firm, am here to assist you.

To discuss your unique situation and explore the best legal strategies tailored to your needs, I invite you to schedule a complimentary consultation. Please feel free to contact us at (702) 433-2889. We’re here to provide the guidance and support you need during this critical time.

Once again, thank you for reading through our resources. I look forward to the opportunity to assist you.

Best regards,

Molly Rosenblum, Esq.